Check Bounce Lawyer In Delhi

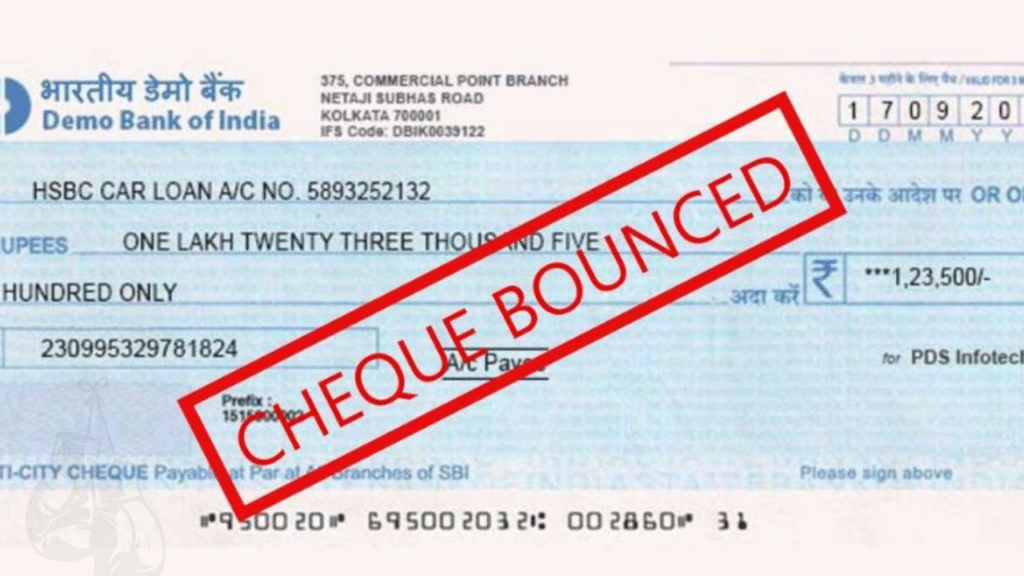

A cheque is one of the most trusted and widely used payment instruments in India. It signifies a promise — a promise to pay the bearer a certain sum of money. But when that promise is broken due to insufficient funds, signature mismatch, account closure, or stop-payment instructions, it leads to what is popularly known as a check bounce. In legal terms, such incidents fall under the ambit of Section 138 of the Negotiable Instruments Act, 1881.

At Public Adalat, we have a dedicated legal team with extensive experience in cheque dishonour cases, offering clients both prosecution and defence services in accordance with Indian law. Our aim is to protect your rights, recover your money, and ensure swift legal action.

Understanding Check Bounce Cases

When a cheque is presented to the bank and it gets returned unpaid, the bank issues a “Cheque Return Memo” specifying the reason for non-payment. Common reasons include:

Insufficient funds in the drawer’s account

Signature mismatch

Account closure

Stop payment instructions from the drawer

Alterations or overwriting on the cheque

Post-dated cheque presented prematurely

If the cheque was issued towards repayment of a legally enforceable debt or liability, its dishonour becomes a criminal offence under Section 138 of the Negotiable Instruments Act.

Legal Framework – Section 138 of the Negotiable Instruments Act

The law lays down certain conditions before filing a cheque bounce case:

The cheque must be presented within its validity period (generally 3 months from the date of issue).

If dishonoured, the payee must send a legal demand notice to the drawer within 30 days of receiving the bank’s memo.

The notice should demand payment within 15 days from the date the drawer receives it.

If payment is not made within those 15 days, a complaint can be filed in court within 30 days thereafter.

Punishment for cheque bounce cases can be:

Imprisonment of up to 2 years, or

Monetary fine up to twice the amount of the cheque, or

Both

Our Expertise in Check Bounce Cases

Public Adalat provides a full range of legal support for cheque dishonour disputes:

For Payees (Complainants):

Drafting and sending the statutory legal demand notice.

Filing the complaint before the Metropolitan Magistrate or Judicial Magistrate First Class.

Representing clients in court for speedy recovery of dues.

Negotiation and settlement through mediation if possible.

For Drawers (Defendants):

Contesting false or malicious cheque bounce claims.

Defending cases where no legally enforceable debt exists.

Filing counterclaims for harassment or misuse of cheques.